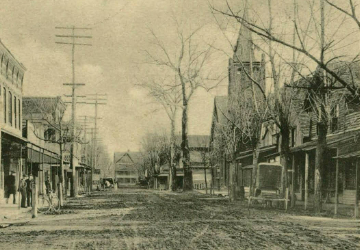

Around 1800, Seaford, located at the head of navigation of the Nanticoke River near its confluence with Herring Creek, began to develop as a village with lots being laid out south of West (now King) Street and east of Market Street. A commercial ferry was established across the Nanticoke to provide access from the south; this would lead to the construction of a toll bridge by about 1832. The rich agricultural land surrounding the rapidly growing town made it a market center.

In 1856, the Delaware Railroad completed its rail line which for a time terminated in the town, allowing easy access to markets in Wilmington and beyond for local farm products and lumber. The Town’s growth continued after the Civil War when a number of canneries were established with a strong emphasis on canning for the oyster industry. It was during this time of great expansion that Seaford formally established its government. In 1865, Seaford was incorporated as the “Commissioners of Seaford.” As described in the Incorporating Act, the Town encompassed the area between the Nanticoke River on the south and the road from Bridgeville to Reliance on the north, and on the west, was defined by the rail line and on the east, by Herring Creek and a line that ran parallel to North Street. Yearly elections were held allowing males and by proxy, unmarried females who owned property, to vote. The five Commissioners were required to be residents and freeholders. They were to meet four times a year and at the first meeting after an election were to appoint an Assessor, a Collector, a Treasurer, and a Town Clerk. The Commissioners had the power to enact ordinances for the good government of the Town, as well as to regulate the streets; to oversee the paving of the sidewalks; to examine chimneys and stovepipes and require their repair; to remove nuisances; to prohibit the firing of guns and the setting off of fireworks; to plant ornamental trees to make and repair public pumps; and all other matters relating to the Town’s general welfare. They were also authorized to assess the real and personal property of the Town’s male residents and to collect taxes in an amount not to exceed $200. They were prohibited from taxing unimproved land. Owners of dogs were taxed fifty cents for each male dogs and $1 for females. A Justice of the Peace residing in Seaford was to serve as Alderman and the County Constable residing in the Town was to serve as Town Constable; they were charged with keeping the peace.1

Several corrections, revisions, and clarifications were made to the 1865 Incorporating Act over the next eighteen years. A law in 1867 made technical corrections.2 In 1869, the Act was revised to indicate that taxes on real and personal property could be not less than $200 or more than $500, and the restriction on taxing unimproved land was lifted; a per capita tax of fifty cents on all white unmarried male citizens was also added.3 In 1871, the Incorporating Act was amended again; the first amendment was that all electors must have paid their municipal taxes in order to qualify to vote; the second was to increase the tax for dog owners to $1 for each male dog and $2 for females; and the third was to eliminate the word “unmarried” from the description of those males who were required to pay a per capita tax.4 An 1873 law indicated that the term of office for Town Commissioners was indicated to be two years, staggered so that three Commissioners were elected in one year and two in the other.5 In 1875, the Levy Court of Sussex County allocated $200 to Seaford to assist the Town in maintaining its streets. In the same year, the General Assembly authorized the time for a special election for Town Commissioners because due to an oversight, the regular time for the election was allowed to pass.6 In 1881, the Commissioners were authorized to sell a piece of ground called the “Market Space” either in whole or in lots, as long as all five Commissioners consented; the monies from the sale was to be placed in the Town’s treasury.7

In 1883, the Town of Seaford was re-incorporated as “The Town of Seaford.” The boundaries were unchanged from 1865, but the form of government was altered. The Town was to be governed by a Council of seven members, with four members elected one year and three the next, each serving a two-year term. The Council members must be resident freeholders or the husband of a resident freeholder. One of Council members was to be chosen by them each year to act as President of the Council presiding over all meetings; his position could be renewed in succeeding years. The Town Council was to meet every other month and had the power to establish ordinances for the good government of the Town. Other Town officials were the Treasurer, Clerk, Assessor, Collector, Alderman, and Town Constables, all of whom were to be reappointed annually. The Alderman was specifically charged with enforcing the ordinances passed by the Council as well as with keeping the peace; he was assisted by the Constables who acted as the Police force. In general, the enumerated powers of the Council were similar to those in the 1865 Act, but they were more specifically stated. The Act included additional procedures and guidelines related to the streets and paving of the sidewalks with the Levy Court of Sussex County to provide $300 annually to assist in the repair of the streets, and property owners liable for the costs associated with paving sidewalks and curbing in front of their property. Taxes were to be levied, assessed and collected on real estate, personal property, and persons. The per capita tax was fifty cents levied against all male residents above the age of 21, and the tax on real and personal property was not to exceed $500 annually.8

It would be twenty-two year before the Town of Seaford would be re-incorporated. During that time a number of laws were passed which amended the 1883 Act. The first, in 1889, reversed the change made in 1883 that limited to voting rights to only males; this law reinstated the right expressed in the 1865 Act that voting in municipal elections was open to all males, over 21 years of age, and to females, over 21, who were freeholders, although females must vote by proxy.9 In 1891, the allocation for road repair provided annually to the Town by Sussex County was increased to $450.10 An 1895 law authorized Seaford to regulate shows and exhibitions, charging fees to provide licenses for them.11

In 1901, two laws were enacted; the first made a number of significant changes to the 1883 Incorporating Act which included: increasing the annual allocation for roads provided by the Levy Court of Sussex County to $600; raising the per capita tax to $1; raising the maximum tax to be levied on real estate and personal property to $1,000 annually; and increasing the number of regular meeting held by the Town Council yearly from six to twelve. The second law provided Seaford with the authority to build and establish a waterworks and sewer system and to provide the apparatus to extinguish fires as well as laying pipes, establishing reservoirs and placing fire hydrants, and authorized the Town to borrow up to $25,000 to accomplish this, levying a special tax sufficient to pay the interest and to establish a sinking fund with which to retire the bonds when due. The law instructed that the rents and fees received for providing water and sewer service were to be used for the maintenance of the systems.12 Two years later, a law similar to the 1901 law which authorized the water and sewer systems, authorized Seaford to borrow $10,000 in order to establish and maintain an electric light plant for public and private use.13 Neither the 1901 nor the 1903 law required the Town to seek referendum approval.

In 1905, the Town of Seaford was re-incorporated. The boundaries established in 1865 had not changed, nor had the form of government established in 1883. While the 1905 Act did incorporate the changes that had been included in laws enacted since 1883, in almost all other ways, the 1905 Incorporating Act mirrored that of the 1883 Act. The one major change was adding a provision which precluded the Town from issuing bonds without the express authority of the Delaware General Assembly, and without first being submitted for approval via a referendum of the Town’s citizens.14

Six years later, Seaford was again re-incorporated. This Act indicated that the Town’s boundaries had been expanded west past Bradford Street parallel to its current western boundary between the Nanticoke River and the road from Seaford to Reliance. The Act also reflected a change in the structure of the government. In addition to the seven Council members, there would also be a Mayor. The Mayor would serve a term of one year and the Council members, three years. The Mayor assumed the duties previously assigned to the Alderman to execute all laws enacted for the government of the Town and to carry into effect all orders of the Council and assigned him the powers of a Justice of the Peace as well as those enumerated responsibilities assigned to the Alderman in previous Incorporating Acts. In addition to the Town officials in the 1905 Act, the Town was now to appoint two Auditors who were to examine the accounts of the Mayor, the Council, the Collector, the Treasurer, and the Water Superintendent, another new office within the Town government. In many ways, this Act aligned with that passed five years earlier. However, there was an expansion of the enumerated powers of the Council which included, among others, regulating the manner of building; regulating the sewer and water systems; regulating the lighting the streets, and preventing swimming or bathing in the Nanticoke River nor in any waters within the limits of the Town. The amount of taxes to be levied had not changed from the 1905 Act, but the new Act did include a provision which allowed manufacturing facilities to be exempt from property taxes for up to ten years. The provision in the 1905 Act governing issuing bonds was amended by removing the requirement for referendum approval of such actions.15 Also in 1911, the water and sewer system was expanded to the newly added portion of the Town. The $4,000 borrowed to accomplish this was to be repaid by adjusting the special tax already in place to repay this debt.16 No amendments to the 1905 Incorporating Act were made prior to the next re-incorporation of the Town.

In 1917, Seaford was re-incorporated, and its boundaries once again expanded to the west to take all of the land between the County Road to Reliance and the River, to the west past Shipley Street. The structure of government was once again changed. The number of Council members was reduced to five with one chosen as President, one as Vice-President, one as Secretary, and another as Treasurer; the latter could also act as Collector if no one else was appointed. The Mayor, an elected position established six years earlier, presided over meetings of the Town Council but was precluded from voting except in case of a tie. The other elected official was the Assessor, a position previously chosen by the Council. All elected officials were to be residents and “substantial” freeholders of the Town. The Mayor was to appoint an Alderman, with whom he had concurrent jurisdiction as a conservator of the peace, as well as Constables to act as a Police force. The Mayor also was to appoint, for a one-year term, a Board of Health to be led by a practicing physician. The Council was to appoint two auditors. The enumerated powers of the Council were the same as had been included in the 1911 Incorporating Act. The 1917 Act contained a new provision that called for the appropriation of up to $500 annually to provide equipment for the fire department as well as support for its maintenance. Town revenue included the per capita tax which was raised to $2 and was assessed on all male citizens of the Town; the real estate and personal property tax which was not to exceed $6,000; an annual allocation of $750 from Levy Court of Sussex County for the repair of roads and streets; and various fees and penalties. Tax exemptions were for manufacturing facilities, as instituted in the 1905 Act, and also for real estate in excess of five acres used exclusively as farmland and not plotted as building lots. The restriction of issuing bonds without the authority of the General Assembly remained.17 Also in 1917, a law was enacted that created a five-member Street and Sewer Commission which was given the authority oversee the paving, guttering, curbing, grading and re-grading of the streets as well as improving the sewers and ensuring that sewer connections are made prior to or at the same time as the street improvements. Up to $25,000 was borrowed to accomplish the sewer and street work and the owners of property abutting the street to be improved were to be assessed two-fifths of the cost of the work per linear foot of their property. These costs could be billed in installments but any fees not paid were to be considered liens on the property.18

There would be numerous amendments to the 1917 Incorporating Act in the twenty-four years until the Town was next re-incorporated. A 1920 law clarified how the list of qualified voters would be determined.19 In 1921, a law authorized the Town to borrow $10,000 in order to purchase a fire engine and fire equipment, and another amended the Incorporating Act so that a per capita tax would be levied on all Town residents.20 Two years later, Seaford was again authorized to incur debt and issue bonds of up to $10,000 with which to extend and enlarge the water system; this law required that a referendum approve the issuing of bonds. Also in 1923, another law would authorize the Town to borrow up to $20,000 to repair and extend the sewer and improve paving on Pine Street from High Street to the county road from Seaford to Reliance; this law also required referendum approval.21 In 1927, two laws were enacted which clarified certain sections of the 1917 Act, one related to the duties of the Treasurer and the other to various actions available to the Council in order to collect monies owed.23 In 1929, after Seaford was authorized to borrow $30,000 with which to extend the sewer system on Market and King Streets and to improve Market Street; one-fifth of the cost of improving Market Street was to be assessed against the properties which abutted it and because of this a referendum was required. Another law enacted in 1929 increased the amount of taxes to be assessed annually to a maximum of $12,000.24 In 1933, a law was enacted which authorized Seaford to borrow up to $50,000 to establish a proper electric light distribution plant, either through construction or purchase of such a facility; referendum approval was required, and a special assessment would ensure the yearly payment of interest and establishment of a sinking fund.25 Also in 1933, a law made multiple changes to the 1917 Incorporating Act including the creation of a new position, the Town Clerk, who was not required to be a Seaford resident, was to assume the duties of the Treasurer, the Tax Collector, the Secretary, and the Water Superintendent. Among the other significant changes in the 19933 law were: the creation of a position of Council Vice-President who would preside at Council meeting in the absence of the Mayor; an allowance for up to 10% of the amount of real property taxes for equipment and maintenance of the Seaford Volunteer Fire Department; a provision for the Council to borrow up to $7,500 without referendum in anticipation of revenue; and a provision for the Council to borrow money with referendum approval for certain municipal projects as long as the bonded indebtedness did not exceed 15% of the value of Seaford’s taxable property.26 In 1937, a law appropriated $10,000 to the Town of Seaford for the improvement work they carried out on High Street from Front Street west to the railroad overpass.27

In 1941, an Act changed the name of the “Town of Seaford” to the “City of Seaford” and established a Charter. The Charter contained a specific description of the boundaries of the City laid out in metes and bounds. The government was vested in a Mayor, who was President of the City Council, and five Council members, all of whom were to be resident freeholders of Seaford; all elected officials served two-year terms. Qualified electors were residents who were over 21, and had paid either their poll and/or property taxes. The City Council was to meet twice a month with the Mayor, or in his absence, the Vice-President of the Council, presiding over the meetings; the Mayor was only to vote at these meetings in the case of a tie. In his role of conservator of the peace, the Mayor was to appoint an Alderman and a Chief of Police, and he was also to appoint a Board of Health. It was the City Council’s responsibility to appoint various other City officials which included the City Manager, Auditors, the City Solicitor, and Board of Assessors. The City Manager, referred to as the Town Clerk when the position was first created in 1933, was to assume the duties of Treasurer, Secretary, Water, and Utility Superintendent, Tax Collector, and receiver of all revenues, rents, and profits accruing to the City. The City was to have all powers requisite to or appropriate for the government of a City, its peace and order, its sanitation, beauty, health, safety, convenience, comfort and well-being of its population. The enumerated powers remained largely unchanged from 1917 although some new powers were added relating to utilities. There had been a number of amendments since 1917 and these were incorporated into the 1941 Charter although in one case there had been a change when the cap on the amount which could be borrowed in anticipation of revenue was increased from $7,500 to $10,000. There were also new provisions in this Charter including: authorizing the City to acquire lands or property, by condemnation, for the purpose of providing sites for public buildings, parks, sewers, sewage disposal plants and water works; requiring that the City receive referendum approval before selling any land with a value in excess of $10,000; and establishing municipal zoning provisions, a Zoning Commission and a Board of Adjustment. While the per capita tax remained at $2, the overall annual cap on taxes increased to $30,000. Tax exemptions were granted for farmland of over five acres not laid out in building lots, and also for manufacturing sites, for a period not to exceed ten years.28

Over the twenty years until the next re-incorporation, there would numerous amendments made to the 1941 Charter. The first amendment was enacted in 1945 at which time the annual cap on taxes was increased to $40,000.29 In 1947, the City proposed an annexation of land to the north of the County Road to Bridgeville (currently Stein Highway) stretching west to the Atlanta Road as well as a piece of land to the west but south of the County Road; a referendum was required before this expansion was approved.30 In 1949, the Charter was amended to increase the maximum amount of taxes levied annually to $50,000. In another law that year, 25% of the gross receipts of the municipal light and power plant was to be set aside in a reserve fund to be held in trust towards the erection of a new plant, in addition to the existing plant or its improvement, and 10% of the gross receipts of the plant was to be similarly set up in a reserve fund for the expansion, replacement, or improvement of the electric transmission lines; these reserve funds were capped at $200,000 and $100,000, respectively.31

An increase of $25,000 on the amount of City property taxes was authorized in 1953 setting the cap at $75,000. Also in that year, new provisions were added to the Charter which authorized Seaford to charge each property connected to the City sewer system an annual service charge which was to be placed in a special fund for paying the interest on and retiring the sewer bonds. This fee was not to exceed 30% of the amount which was the property owner was being charged for water rents.32 In 1955, six laws were enacted which, for the most part, made minor changes to the Charter; however, two significant changes were the increased cap on property taxes to $110,000 and an expansion in the City’s boundaries to the northeast consisting of 385 acres located between the Old Bridgeville Highway (Route 13A) and the new dual highway (Route 13).33 Another five laws were passed in 1957, again with mostly containing minor or technical changes; one did provide for the annexation of a thirteen-acre lot west of the Westview Extended sub-division bounded by the Pennsylvania Railroad line on its south side.34 In three laws enacted in the year prior to the City’s re-incorporation, the Mayor was authorized to appoint an Assistant Alderman, the cap on property taxes was increased again to $160,000, and the annual charge for sewer service was decreased to no more than two times the amount charged for water rent.35

In 1961, the Charter of Seaford was amended and revised. The stated metes and bounds indicated that the City had expanded once again including new territory both to the north of the current Stein Highway and also farther to the west, south of Stein Highway. This amended Charter also provided for future annexation of contiguous land outlining the procedure by which such an action would be accomplished and requiring approval by special election in which each property owner in the City and in the territory to be annexed would be assigned one vote for each $100 of property assessment. There was no change from the 1941 Charter in the structure of government, nor were there changes in the City officials named in the prior Charter except for the addition of an Assistant Alderman, approved in the previous year. This Charter contained a reference to City employees and authorized a pension plan and, or a health and welfare plan. Most of the provisions of the 1941 Charter were retained; some were expanded or clarified. The 1949 revision to the Charter which required that 35% of the gross receipts of the municipal light and power plant be set aside in a reserve fund was included as part of the revised Charter, as was the provision for an annual service fee for sewer services, included as part of a 1953 amendment. The tax to be levied on real property was increased to a maximum of $175,000; exemptions remained unchanged. The amount of the per capita tax was not specified in the Charter; it was to be set yearly by the City Council. The Charter contained expanded procedures related to tax delinquency which specified penalties and which could ultimately result in the sale of real or personal property in order to recover the taxes owed.36

The first amendment to the 1961 Charter, made in 1962, changed the annexation process.37 In 1965, two laws were passed; one provided for the appointment of an Assistant City Manager and one allowed the City to charge a collection fee of up to 18% in addition to other interest and penalty charges when collecting delinquent taxes.38 A 1967 law changed the way of calculating the amount of funds to be placed in a reserve fund for municipal light and power from 25% of gross receipts to 25% of net receipts. Also in 1967, additional changes were made to the annexation process and the property tax cap was increased to $225,000.39 A new voter registration system was initiated by changes made in a 1969 law.40 In 1970, the property tax abatement provisions in the Charter were eliminated, and the City was permitted to establish a service charge for those who manufacture and sell electric current.41 The cap on property taxes was once again increased in 1971, to $300,000.42 In 1972, in three laws, the voting age was lowered to 18; the voting procedures were revised; the amount to be placed in the reserve fund for light and power was amended to 1% of the net receipts; and the cap on the floating debt was increased from $10,000 to $100,000.43 A 1974 law increased the cap on property taxes to $500,000.44 Voter qualifications and qualification for elective office were amended in 1975; and a tax exemption for the elderly was added.45 In 1976, the cap on debt in anticipation of revenue was increased to $200,000.46 The procedures in the Charter for referendums related to annexation and the issuance of bonds were revised in 1978 so that weighted voting was eliminated; each eligible voter had one vote. The same year voting by absentee ballot was legalized, and another law revised the procedures for issuing bonds.47 Two laws enacted in 1980 contained Charter revisions. The first of these included a number of provisions among which were: to exempt from municipal property taxes any land used for recreational purposes by non-profits; to revise the annexation procedures; to authorize an increase to $50,000 in the value of land which Seaford could sell without referendum approval; to increase the cap on bonded indebtedness to 25% of the value of taxable real estate; and to eliminate the restriction on the amount of the sewer fee. The second law provided Seaford with the authority to issue revenue bonds which would not factor into the cap placed on bonded indebtedness as these would be repaid from the projected revenue; these could be used for a number of specified municipal purposes related to providing water, sewer, electricity or gas or any permanent municipal project as well as for the purchase of land and buildings for an industrial complex which will be sold, or the acquisition, construction or reconstruction of a commercial complex requiring a capital investment of more than $500,000.48 In 1981, the Charter was amended to clarify that it was the responsibility of the City Manager to collect all fees owed the City, and that any delinquent fees would be a lien on the property for ten years.49 Further changes were made to the Charter in 1982 related to the City Manager and the Assistant City Manager who were now to be appointed for indefinite terms, rather than yearly; the City Manager was given responsibility for the proper administration of the City with the power to appoint and remove all officers and employees except the Chief of Police.50 A law enacted in 1983 raised the cap on the amount which could be borrowed in anticipation of revenue to $750,000, and another law that year amended the Charter by adding procedures by which to appeal a decision made by the Board of Adjustment.51 In 1985, the cap on property taxes was increased to no more than $2 million annually. Another law gave Seaford the authority to prepare a supplemental quarterly assessment to be used to correct errors, remove or modify exemptions, or determine the assessment for newly-constructed buildings.52 The qualifications of those running for elective office were revised in 1986 to eliminate the requirement that the Mayor and Council members be freeholders. Another law that year raised the cap for City property that could be sold without referendum approval to $2 million.53 Minor technical revisions were made as part of a 1987 law.54 In 1988, a law contained thirty-four revisions to the Charter; among the changes made were: changing the title of the Vice-President of the City Council to Vice-Mayor; eliminating the Mayor’s responsibility as conservator of the peace; establishing the powers and functions of the City Police as the same as those contained in Del. C. §11 and §21; and clarifying the responsibilities of the City Manager in overseeing City employees.55 In 1989, Seaford was authorized to collect a tax on the transfer of real estate if approval of this was obtained by referendum vote.56 In 1990, minor revisions were made to the Charter’s provisions for issuing revenue bonds.57 A 1991 law increased the City Council member’s terms from two years to three, and also made minor changes in the responsibilities of the City Manager and the election process.58 The procedures for collecting taxes was revised in a 1998 law.59

A 2001 law made minor revisions related to the supply of electric current.60 In 2006, a law again increased the cap on the value of a property that the City could sell without voter approval, to $5 million [noted in the law as $5 billion but corrected in a subsequent law].61 Two laws in 2007 made a number of significant changes to the Charter: the cap on property tax was increased to $5 million annually; the cap on floating debt was increased to $2 million; the amount of the transfer tax was increased from 1% to 1.5%; election procedures were revised to be in compliance with Delaware Code; revisions were made to the tax assessment process; and new provisions were added related to special development districts and tax increment financing.62 A technical correction to the process for taxing the transfer of tax real estate was made in 2010.63 In 2015, absentee balloting was allowed for annexation and bond referendums, and weighted voting for bond referendums was eliminated.64 Additional revisions made to the Charter by a 2018 law revised the procedures under which Seaford would sell property to recover delinquent taxes, and also those related to the annexation process.65

For the fully amended text of the current Charter, see http://www.charters.delaware.gov/seaford.shtml

CITATIONS in Del. Laws

1 12 Del. Laws, c. 541 (1865) [pp. 613-17]

2 13 Del. Laws, c. 178 (1867) [pp. 182-83]

3 13 Del. Laws, c. 482 (1869) [p. 524]

4 14 Del. Laws, c. 118 (1971) [p. 144]

5 14 Del. Laws, c. 533 (1873) [pp. 583-84]

6 15 Del. Laws, c. 15 and c. 158 (1875) [pp. 34-35 and pp. 281-82]

7 16 Del. Laws, c. 486 (1881) [p. 630]

8 17 Del. Laws, c. 176 (1883) [pp. 320-38]

9 19 Del. Laws, c. 651 (1889) [p. 868]

10 19 Del. Laws, c. 241 (1891) [p. 477]

11 20 Del. Laws, c. 112 (1895) [p. 175]

12 22 Del. Laws, c. 187 and c. 188 (1901) [p. 417 and pp. 418-24]

13 22 Del. Laws, c. 433 (1903) [pp. 921-25]

14 23 Del. Laws, c. 194 (1905) [pp. 413-33]

15 26 Del. Laws, c. 234 (1911) [pp. 561-87]

16 26 Del. Laws, c. 235 (1911) [pp. 588-91]

17 29 Del. Laws, c. 153 (1917) [pp. 487-519]

18 29 Del. Laws, c. 154 (1917) [pp. 520-32]

19 31 Del. Laws, c. 39 (1920) [p. 96]

20 32 Del. Laws, c. 147 and c. 148 (1921) [pp. 436-37 and p. 438]

21 33 Del. Laws, c. 148 and c. 149 (1923) [pp. 424-26 and pp. 427-39]

22 34 Del. Laws, c. 147 and c. 148 (1925) [p. 372 and pp. 373-76]

23 35 Del. Laws, c. 134 and c. 135 (1927) [p. 448 and p. 339]

24 36 Del. Laws, c. 189 and c. 190 (1929) [p. 574-81 and p. 582]

25 38 Del. Laws, c. 121 (1933) [pp. 484-87]

26 39 Del. Laws, c. 25 (1933) [pp. 83-88]

27 41 Del. Laws, c. 164 (1937) [pp. 553-54]

28 43 Del. Laws, c. 184 (1941) [pp. 807-50]

29 45 Del. Laws, c. 171 (1945) [pp. 644-45]

30 46 Del. Laws, c. 281 (1947) [pp. 810-13]

31 47 Del. Laws, c. 61 and c. 62 (1949) [p. 105 and pp. 106-07]

32 49 Del. Laws, c. 254 and c. 265 (1953) [p. 478 and p. 492]

33 50 Del. Laws, c. 56, c. 108, c. 109, c. 200, c. 201, and c. 202 (1955)

[p. 94, p. 181, p. 182, p. 370, p. 371, and pp. 372-73]

34 51 Del. Laws, c. 116, c. 117, c. 118, c. 158, and c. 224 (1957)

[p. 179. P. 180, p. 181, p. 325, and p. 429]

35 52 Del. Laws, c. 271, c. 272, and c. 327 (1960) [p. 586, p. 587, and p. 769]

36 53 Del. Laws, c. 42 (1961) [pp. 87-147]

37 53 Del. Laws, c. 332 (1962) [pp. 856-57]

38 55 Del. Laws, c. 41 and c. 99 (1965) [p. 102 and p. 386]

39 56 Del. Laws, c. 56, c. 90, and c. 200 (1967) [pp. 269-70. Pp. 352-53, and p. 661]

40 57 Del. Laws, c. 103 and c. 316 (1969) [p. 175 and pp. 1001-02]

41 57 Del. Laws, c. 380 and c. 441 (1970) [p. 1126 and p. 1245]

42 58 Del. Laws, c. 28 and c. 196 (1971) [p. 36 and p. 633]

43 58 Del. Laws, c. 387 and c. 586 (1972) [pp. 1166-67 and pp. 2017-18]

44 59 Del. Laws, c. 283 (1974) [p. 942]

45 60 Del. Laws, c. 71 (1975) [p. 131-33]

46 60 Del. Laws, c. 516 (1976) [p. 1792]

47 61 Del. Laws, c. 259, c. 289, and c. 451 (1978) [pp. 807-08, p. 874, and p. 1292]

48 62 Del. Laws, c. 290 and c. 367 (1980) [pp. 685-87 and pp. 856-61]

49 63 Del. Laws, c. 46 (1981) [p. 56]

50 63 Del. Laws, c. 343 (1982) [p. 733]

51 64 Del. Laws, c. 4 and c. 56 (1983) [p. 8 and p. 126]

52 65 Del. Laws, c. 21, c. 94, and c. 97 (1985) [p. 19, p. 186, and p. 192]

53 65 Del. Laws, c. 248 and c. 249 (1986) [p. 488 and p. 489]

54 66 Del. Laws, c. 19 (1987) [p. 27]

55 66 Del. Laws, c. 327 (1988) [pp. 702-05]

56 67 Del. Laws, c. 31 (1989) [pp. 37-38]

57 67 Del. Laws, c. 312 (1990) [p. 699]

58 68 Del. Laws, c. 127 and c. 186 (1991) [p. 395 and p. 617]

59 71 Del. Laws, c. 267 (1998) [p. 712]

60 73 Del. Laws, c. 64 (2001) [pp. 101-02]

61 75 Del. Laws, c. 394 (2006) [p. 530]

62 76 Del. Laws, c. 44 and c. 153 (2007) [vol. I, p. 36 and vol. I, p. 208-10]

63 77 Del. Laws, c. 297 (2010) [vol. II, p. 88]

64 80 Del. Laws, c. 101 and c. 272 (2015)

[http://delcode.delaware.gov/sessionlaws/ga148/chp101.shtml]

[http://delcode.delaware.gov/sessionlaws/ga148/chp272.shtml]

65 81 Del. Laws, c. 330 (2018) [http://delcode.delaware.gov/sessionlaws/ga149/chp330.shtml]

Delaware Laws from 1935 to present can be found online at: http://delcode.delaware.gov/sessionlaws/

City of Seaford records at the Delaware Public Archives include:

jnl / April 5, 2019 | April 22, 2019

Related Topics: Delaware History, Seaford, Town and City Histories