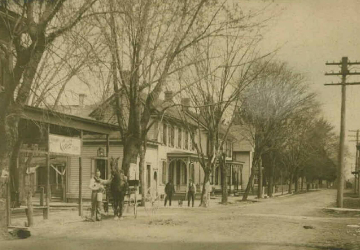

The Town of Wyoming is located about a mile west of the Town of Camden in an area of rich agricultural land. By the nineteenth century, a community had formed, known as West Camden. In the 1850s, when the Delaware Railroad was plotting the line of its track through the state, Camden urged the railroad to run the tracks through this area to its west rather than closer to the center of Camden, spurring rapid growth in the area. By 1865, town lots had been laid out on both sides of the railroad tracks, and a town, called Camden Station, had formed. When it came time to establish a post office, the residents of the new Town decided to change its name to establish their independence from Camden. As one of the men who laid out the town was from Wyoming Valley, Pennsylvania, Wyoming was chosen. The Town of Wyoming was incorporated in 1869 in the corporate name of the “Commissioners of Wyoming.” In general terms, the boundaries of the Town were near the mill pond at its northern limits and the public road leading from Camden to the Kent County Almshouse (new partially Southern Boulevard) at its southern limits, near a stream running south from the mill pond on the west, and at the boundary of the Town of Camden on the east. Elections were to be held annually to elect three Commissioners who were to be resident freeholders of the Town. All taxable residents of the Town, over the age of 21, including unmarried females who were to vote by proxy, were qualified to be electors. The Commissioners were to meet four times annually to adopt ordinances for the good government of the Town, the improvement of streets, the paving and other improvements of the sidewalks, and all other matters relating to the Town, its policy, ornaments, improvement, and general welfare. Appointed Town officials included an Assessor, a Tax Collector, and a Treasurer. The duties of Alderman were to be the responsibility of any Justice of the Peace residing in or near the Town. Similarly, the nearest County Constable would serve as Town Constable. Taxes were to be assessed on all white males over 21 who resided in the Town and on the real and personal property of all freeholders. The amount of the tax was not to exceed $300 annually. Owners of keepers of dogs were also to be taxed fifty cents per dog.1 The Levy Court of Kent County was to assist towns in maintaining streets, and in 1875, they acknowledged this in a law which provided for the allocation of $60 annually for this purpose.2

In 1887, the Town of Wyoming was re-incorporated. The limits of the Town had changed little in the years since the Town was first incorporated. The Act specified that while elections would be held annually, each of the three Commissioners were to serve a three-year term. The Commissioners met for an annual meeting immediately after the elections and thereafter, four times a year. At their annual meeting, which was indicated in the 1887 Incorporating Act to be a Town meeting open to all taxpayers, an annual report was to be presented showing the conditions of the finances and condition of the Town. The duties of the Commissioners included passing needful ordinances related to regulating the Town and the conduct of its residents, to define nuisances, to regulate the roads and sidewalks, to provide against noisy and turbulent gatherings, to regulate chimneys and stovepipes, and to regulate dangerous sports or practices that “could bring fear” to the Town’s residents. The Commissioners were also to regulate and maintain existing streets and lay out new ones, assisted by an allocation of not less than $100 annually from the Kent County Levy Court, and also oversee the laying of sidewalks, although the cost of this was the responsibility of the property owner. The Town officials to be appointed by the Commissioners included the Town Clerk, an Alderman, a Town Constable, an Assessor, and a Treasurer who was to be both the receiver and collector of taxes. All Town officials were to serve one-year terms. The Assessor was to value all of the real estate within the Town limits, all of the male citizens over 21, and all of the cows and horses, as well as all owners or keepers of dogs as they were to be charged fifty cents for each male dog and $1 for each female dog. The maximum amount of the taxes to be levied annually was $300.3 In 1893, the Commissioners were authorized to borrow $400 with which to purchase fire equipment; the loan was to be repaid within four years by levying a special tax to ensure its payment.4

In 1905, a law re-incorporating the Town of Wyoming was enacted. In most ways, this Act mirrored that of 1887. The one major change was increasing the number of Commissioners from three to five. It was required that all be residents of the Town, but only three were required to be freeholders. In addition, the annual allocation of monies from the Kent County Levy Court was increased to $200 and the taxes which could be levied on real estate was increased to not more than $600.5

The next re-incorporation would not take place for thirty-six years. During that time, there were a number of amendments made to the 1905 Incorporating Act. In 1909, the appropriation from Kent County for road maintenance was increased to $300 for a period of two years only.6 In 1911, the maximum tax that could be levied on real estate was increased to a maximum of $800 annually.7 The appropriation from Kent County increased again in 1913 to not less than $400, but it was to return to $200 after two years.8 Amendments in 1915, removed horses and cows from being assessed and increased the maximum tax to be levied to $1,500 annually. In addition, penalties were specified if property owners did not comply with the procedures for laying sidewalks.9 A law enacted in 1917 set the annual allocation from the Kent County Levy Court to be $300.10 In 1919, the Town of Wyoming was authorized to borrow up to $10,000 with which to purchase the equipment and supplies required to light the streets and to furnish an adequate water supply. A special tax was to be levied to pay the interest on the bonds and to establish a sinking fund to retire the bonds. No action could be taken without referendum approval.11 A further increase in the maximum tax to be levied was part of a law approved in 1920; the new cap was set at $2,000.12 The level of taxes was increased again in 1923, to $3,000. Also in 1923, Wyoming was authorized to borrow $5,000 for a sewer system with similar terms as contained in the earlier law allowing for bonded debt.13 In 1927, the maximum amount of taxes levied annually was increased to $5,000.14 In 1933, a number of changes were made to the 1905 Incorporating Act, including a large annexation of land along its southern boundary. Manufacturing industries in the newly annexed territory were to be exempt from taxation for ten years and any new such industries which were built in the Town were to be exempt for fifteen years. In addition, farmland of six acres or more which had not been laid out into building lots was to be assessed at a maximum of $30 an acre exclusive of any buildings. Another change contained in the law related to Town officials; to this time, the Treasurer had been both the collector and receiver of taxes, but now these Town positions were separated. In addition, the Town’s powers were expanded by allowing them to issue building permits and requiring that such permits be obtained prior to undertaking construction in the Town.15

In 1941, Wyoming was re-incorporated in the corporate name of “The Town of Wyoming” and a Charter was established. The boundaries listed in the Charter, in general, reflected those in a 1933 law when the Town boundaries were amended and expanded. Rather than a Board of Commissioners, the powers conferred by the Charter were vested in a five-member Town Council who were to meet monthly to establish ordinances under which the Town would be governed. The members of the Council were to over the age of 21, residents and non-delinquent taxables of the Town, and three of them were required to be freeholders. They were to serve three-year terms. Elections were held annually with eligible voters being all citizens, over the age of 21, who had paid their taxes. At their annual meeting after an election, the Town Council was to choose one of their members to serve as President, whose duties included presiding over all Council meetings as well as have general superintendence of municipal affairs; one as Secretary; and one as Treasurer. Town officials chosen by the Town Council included a Collector of Taxes, a Town Solicitor, an Assessor, an Auditor, a Police Officer, and an Alderman. The 1941 Charter contained a much more comprehensive list of enumerated powers. Among these were: to prevent the introduction and spread of infectious diseases; to define and abate nuisances; to ascertain, regulate, drain, and maintain streets; to repave and improve sidewalks; to improve gutters and curbs; to approve all inlets into lots and proscribe the extent of building onto sidewalks; to regulate the pedestrians, automobiles and animals in the streets; to make and enforce parking regulations; to construct, extend, and maintain a water system providing water mains and fire hydrants; to construct, extend and maintain a sewer system; to control the drainage of water courses; to contract for the purchase of electric current and gas for power and light; to register dogs and prevent their running at large; to regulate the keeping of pigs and hogs; to grant or refuse licenses for amusements and pool or billiard rooms; to prevent, suppress and regulate all bonfires, the firing of firearms and exploding of fireworks; to regulate chimneys; to regulate storage of combustible material; to define, investigate and abate fire hazards; to appropriate money for the purpose of providing fire equipment; to establish zoning; to condemn buildings which present a fire hazard; to regulate building and building materials in order to prevent fires; and to require a building permits when constructing any building. The Town Council was required to determine annually the amount of funds which would be required to defray the Town’s expenses including interest on bonded indebtedness and the redemption of any maturing bonds. The majority of these funds were derived by levying a tax on real and personal property; the maximum amount of taxation annually was set at $5,000. Farmland within the Town was exempt from taxes unless it was laid out into building lots which fronted on an existing public street. Discounts for paying taxes early were provided as were penalties for late payment. The procedures for handling tax delinquency were specified and could result in the sale of the property. Additional revenue was obtained through business license fees and from fees to those who provide utility services as well as fines of up to $100 for violating Town ordinances. The Town of Wyoming was authorized to borrow money and issue bonds in order to provide funds for furnishing water, constructing or repairing streets and gutters or sewers, or any permanent municipal improvement project as long as the total borrowed, in aggregate, did not exceed 10% of the value of the Town’s real property. The Council could also borrow up to $1,000 in any one fiscal year as a floating debt when the needs of the Town demanded it.16 Numerous amendments would be made to the 1941 Charter in the sixty-one years until it was fully revised. In 1949, in two separate laws, the cap on the amount of taxes that could be levied annually was increased to $10,000, and the cap on the floating debt was increased to $5,000. Also in this year, an annexation of additional lands south of the Town was proposed;17 the annexation law was repealed in 1953.18

A change in the cap on real estate taxes was part of the laws enacted in 1955 when the amount was increased to $12,000,19 and in 1957, when it was increased to $20,000.20 In 1963, the Charter was revised to establish procedures for annexing land and to require a referendum if annexation was proposed.21 In 1970, a law made a number of revisions to the Charter among which were: to allow females to seek elective office; to eliminate non-delinquent taxpayer as a qualification to seek elective office and to eliminate holding elections for non-contested offices.22 In 1978, the maximum annual taxation was increased from $20,000 to $35,000.23 As the rail station located in the center of Town was no longer in active use by the railroad, a 1980 law authorized the Town to borrow $20,000 to purchase it from the Delaware Railroad Company.24 [The old railroad station is currently Wyoming’s Town Hall]. In 1983, an expanded procedure for annexing territory into the Town was added to the Charter; a referendum was required unless the property was exempt from taxation.25 Some significant revisions to personnel were part of Charter revisions made in 1984: a new position was established, the Town Clerk, whose duties included those previously carried out by the Collector of Taxes, a position now eliminated; a Board of Assessment now took the place of a single Assessor; the position of Alderman was eliminated, and a Building Inspector was appointed. Among several other revisions contained in this law, the maximum level of real estate taxes was increased to $50,000 annually.26 Two years later, the Charter was again revised by a major change to the structure of the Town’s government. The Town of Wyoming would now be governed by a Mayor and a four-member Town Council, all of whom would serve two-year terms. The Mayor was to preside at Council meetings and could vote on all matters before it. A Vice-Mayor, a Secretary and a Treasurer were to be chosen from among the Council members. This 1986 law also increased the maximum tax that could be levied to $50,000 and lowered the voting age to 18 years and older.27 In 1990, the maximum annual tax level was increased again, to $125,000.28 An additional source of revenue became available to the Town in 1991 when the collection of a 1% tax on the transfer of real estate was authorized.29 A law enacted in 1995, again increased to $250,000 the maximum level to which real estate could be taxed, and also authorized the Town to recover reasonable attorney’s fees when bringing a legal action for the collection of taxes.30 In 1997, the annexation procedures in the Charter were amended, and the restriction on compensation for Council members was lifted.31 The Charter procedures by which candidates were nominated for elective office were revised in 1999.32

In 2000, the Town’s maximum level of taxation on real property was increased to $400,000, and the debt limit on floating debt to meet the Town’s needs for funds in advance of revenue was increased to $50,000.33 Laws enacted in 2003, 2008, and 2009 contained numerous revisions to the Charter which would lead up to a complete amendment of the Charter in 2010. Among the revisions to the Charter in 2003 were: inserting a definition for what is meant by “residing in the Town” to be used in determine if a candidate was qualified to seek elective office; revising the provisions for exempting or reducing taxation on properties to include only manufacturing businesses, newly-annexed land, and property owned by those over 65 years of age or those totally disabled; revising the procedures for the collection of taxes; instituting a policy of adding any municipal charges owed by a taxpayer to their annual tax bill; and eliminating the requirement to appoint a Board of Health.34 Among the revisions to the Charter in 2008 were: revising the Charter’s nomination and election procedures including providing for absentee balloting; acceptance of the county assessment as the basis for municipal taxation; reinstating the requirement to appoint a Board of Health; increasing the property taxes to a maximum of $600,000 annually; increasing the cap on floating debt to $125,000, in aggregate, unless a referendum authorizes additional debt; and instituting a new provision to charge impact fees on new development or construction in order to recover Town costs related to the installation or expansion of utility or street improvements.35 A few minor revisions to the Charter were included in a 2009 law.36

In 2010, the Charter of the Town of Wyoming was fully amended, and many of the revisions that had been enacted by law over the ensuing sixty-one years, particularly the most recent changes, were incorporated into the revised Act. The metes and bounds of the Town were no longer part of the Charter; the public record of these was now maintained by the Kent County Recorder of Deeds. An annexation policy had been enacted in 1997 and these were updated and included in the new Charter. The structure of government had been changed in 1986 to call for the powers of the Town to be vested in a Mayor and a four-member Council; Council officials remained the Vice-Mayor, Secretary and Treasurer. This governmental structure was retained, although the Mayor’s term of office was now extended to three years. The Charter reflected that many election rules were now governed by state law, but one interesting local rule called for a tie election to be settled by a coin toss. Appointed Town officials included a Town Finance Clerk who was the Collector of Taxes, a position created in 1984, a Town Solicitor, a Building Inspector, a Chief of Police and Police Officers with the last two being optional appointments. The specific, enumerated powers of the Town contained in this Charter have been updated, but include many powers listed in the 1941 Charter. New procedures address the Town’s powers related to subdivision and land development as well as those associated with impact fees. In 2008, the Town of Wyoming had determined to accept the assessment of the Kent County for purposes of municipal taxation and this is reflected in the revised Charter. The Town was to establish a tax rate that would result in raising adequate funds to meet the Town’s needs including the interest due on any outstanding bonds as well as monies for a sinking fund. In 2008, the maximum amount of taxation had increased to $600,000 and this remained unchanged. As provided for in certain 2003 amendments, the Town also added the fees for any additional municipal services to the property owner’s tax bill. The Charter simplified the exemption for farmland to indicate that such property would only be taxed if a subdivision plan was on file, and incorporated the other rules on exemptions adopted in 2003. Short-term borrowing, previously referred to as a floating loan, remained capped at $125,000. The cap on long-term borrowing, for certain specified public purposes after voter approval, was decreased to 5% of the assessed value of real property within the Town.37

The 2010 Charter was revised in 2013 by a number of minor and technical corrections. The major change included in this law was the elimination of weighted voting in annexation referendums; rather than being tied to the amount of taxes paid, each property owner now had just one vote.38 In 2016, a law increased the maximum tax that could be levied on the Town to $1.5 million annually.39

For the fully amended text of the current Charter, see http://www.charters.delaware.gov/wyoming.shtml

CITATIONS in Del. Laws

1 13 Del. Laws, c. 477 (1869) [pp. 496-501]

2 15 Del. Laws, c. 157 (1875) [p. 281]

3 18 Del. Laws, c. 160 (1887) [pp. 258-269]

4 19 Del. Laws, c. 749 (1893) [pp. 1058-59]

5 23 Del. Laws, c. 182 (1905) [pp. 314-26]

6 25 Del. Laws, c. 191 (1909) [p. 371]

7 26 Del. Laws, c. 226 (1911) [p. 517]

8 27 Del. Laws, c. 235 (1913) [p. 668]

9 28 Del. Laws, c. 141 (1915) [pp. 437-39]

10 29 Del. Laws, c. 150 (1917) [p. 470]

11 30 Del. Laws, c. 136 (1919) [pp. 307-08]

12 31 Del. Laws, c. 37 (1920) [pp. 92-93]

13 33 Del. Laws, c. 135 and c. 136 (1923) [p. 393 and pp. 394-98]

14 35 Del. Laws, c. 143 (1927) [p. 466]

15 38 Del. Laws, c. 124 (1933) [pp. 495-98]

16 43 Del. Laws, c. 189 (1941) [pp. 858-905]

17 47 Del. Laws, c. 48, c. 87, and c. 88 (1949) [pp. 88-90, pp. 138-39, and pp. 140-41]

18 49 Del. Laws, c. 248 and c. 249 (1953) [p. 459 and p. 460]

19 50 Del. Laws, c. 315 (1955) [p. 641]

20 51 Del. Laws, c. 40 (1957) [p. 54]

21 54 Del. Laws, c. 128 (1963) [pp. 397-99]

22 57 Del. Laws, c. 769 (1970) [pp. 2324-25]

23 61 Del. Laws, c. 293 (1978) [p. 885]

24 62 Del. Laws, c. 187 (1980) [pp. 450-51]

25 64 Del. Laws, c. 9 (1983) [pp. 19-21]

26 64 Del. Laws, c. 238 (1984) [pp. 569-70]

27 65 Del. Laws, c. 384 (1986) [pp. 778-79]

28 67 Del. Laws, c. 203 (1990) [p. 430]

29 68 Del. Laws, c. 56 (1991) [p. 112]

30 70 Del. Laws, c. 206 (1995) [p. 513]

31 71 Del. Laws, c. 54 (1997) [p. 91]

32 72 Del. Laws, c. 14 (1999) [p. 25]

33 72 Del. Laws, c. 373 (2000) [p. 649]

34 74 Del. Laws, c. 65 (2003) [pp. 86-89]

35 76 Del. Laws, c. 356 (2008) [vol. II, pp. 209-11]

36 77 Del. Laws, c. 17 (2009) [vol. I, pp. 23-24]

37 77 Del. Laws, c. 450 (2010) [vol. II, pp. 443-60]

38 79 Del. Laws, c. 108 (2013) [http://delcode.delaware.gov/sessionlaws/ga147/chp108.shtml]

39 80 Del. Laws, c. 239 (2016) [http://delcode.delaware.gov/sessionlaws/ga148/chp239.shtml]

Delaware Laws from 1935 to present can be found online at http://delcode.delaware.gov/sessionlaws/

Town of Wyoming records at the Delaware Public Archives include:

jnl / April 5, 2019 | April 23, 2019

Related Topics: Delaware History, Town and City Histories, Wyoming